A Full Lifecycle Platform for Fintech App Development

Build, Manage, and Optimize While Maintaining Security and Competitiveness

Robust security measures are paramount in fintech product development. With digital transformation on the agendas of boardrooms everywhere, integration with legacy banking ecosystems is necessary. But this demands seamless cross-platform and API connections and real-time data synchronization, which isn’t always easy to achieve in fintech mobile app development.

Scalability issues arise as fintech apps grow, necessitating a solid system architecture and infrastructure for high transaction volumes and real-time data processing. Continuous innovation and adaptation to emerging technologies in financial software development are crucial to staying competitive and meeting evolving user expectations.

When facing these challenges, several questions present themselves, including:

How can we ensure the highest level of security for sensitive financial data?

PubNub enhances the security of sensitive financial data through end-to-end encryption, secure access management, and real-time monitoring. This ensures compliance with industry standards and protects against data breaches. Our robust infrastructure and 15 global Points-of-Presence (PoPs) also provide reliable and low-latency data transmission.

What strategies can we implement to integrate with legacy banking systems seamlessly?

How can we design our infrastructure to handle the high transaction volumes and real-time data processing that come with financial services apps?

Is it more cost-effective to build a solution in-house, or would outsourcing the infrastructure to a third party make better sense?

Can PubNub help me comply with ISO 20022?

A Full Lifecycle Platform for Fintech App Development

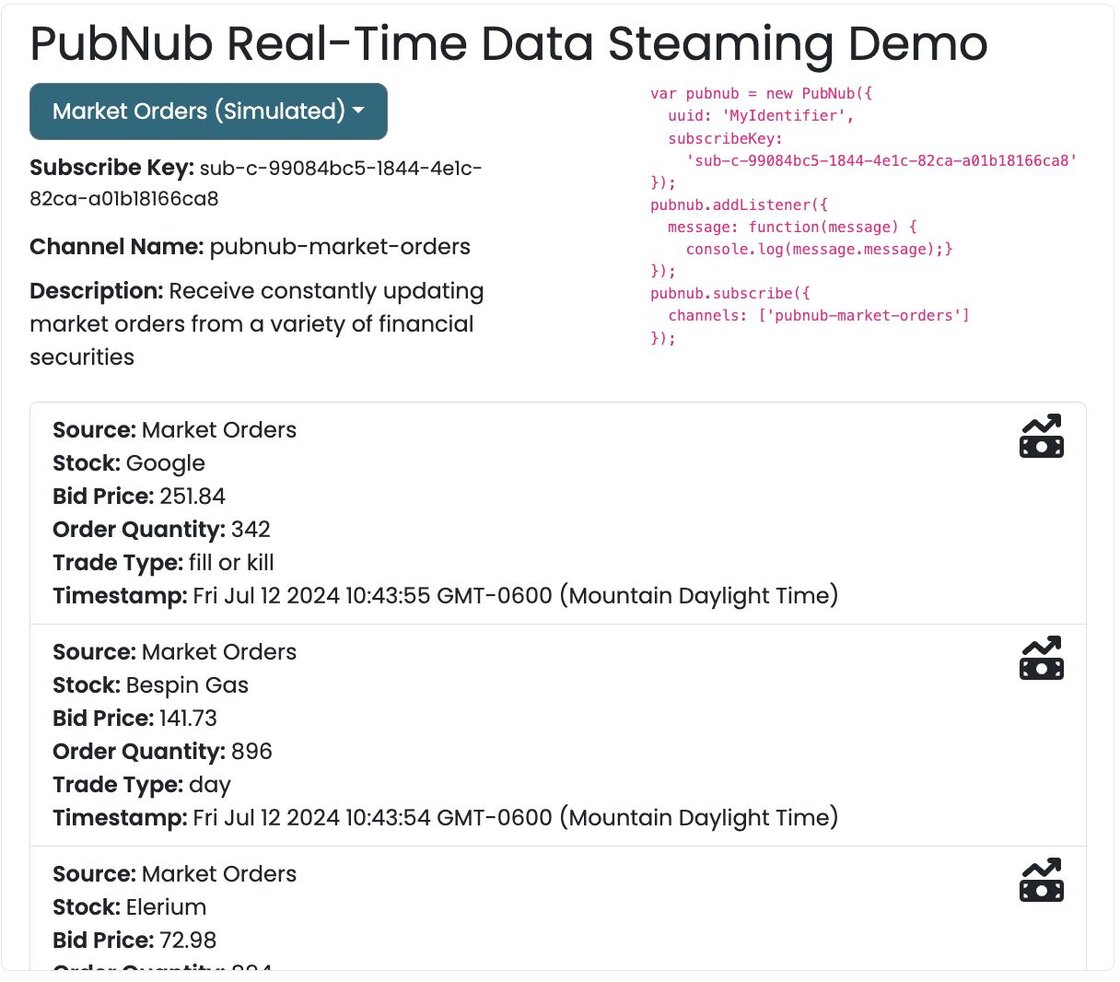

Real-Time Market Data Feeds

Stream live financial data, such as stock prices, forex rates, and cryptocurrency values, to provide users with up-to-the-second trading information to make informed decisions.

Secure API Integrations

Ensure secure and seamless integration with third-party financial services and legacy banking systems through robust API support, facilitating interoperability and data exchange.

Secure Financial Messaging

Enable secure, encrypted communication between users and financial institutions, ensuring sensitive information remains confidential and protected.

Fraud Detection Alerts

Implement real-time fraud detection and alert systems to instantly identify and respond to suspicious activities, safeguarding user accounts.

Account Aggregation and Syncing

Facilitate real-time syncing of account balances and transaction histories across multiple financial institutions, providing users with a comprehensive view of their finances.

Real-time Alerts & Notifications

Set up automated alerts for events such as reaching spending limits, payment due dates, or significant market movements, helping users stay informed and manage their finances effectively.

Stream any financial data to dashboards and apps

Real-time updates provide valuable insights on the fluctuating market and keep them up to date on gains and losses - an essential need for every investor.

Why PubNub?

FinTech App developers look to PubNub for reliable, real-time communication and seamless integration for scalable FinTech solutions.

Pub/Sub Messaging

Efficiently manage real-time communication between users, devices, chatbots, and servers, facilitating instantaneous data exchange.

Event-Driven Triggers

Real-time triggers for specific events, such as transaction completion, money transfers, or threshold breaches, automating processes and immediate responses.

Data Residency Options

Choose where your data is stored and processed to ensure compliance with local data protection laws, enhancing data sovereignty and regulatory adherence.

Serverless Functions

Run business logic on data streams in real-time, allowing for on-the-fly data processing, auditing, filtering, and transformation without additional infrastructure with PubNub Functions.

Flexible APIs and SDKs

Integrate real-time capabilities quickly and efficiently into your FinTech app, accelerating development and deployment.

Regulatory Compliance

We support compliance with financial industry regulations and standards like PSD2, GDPR, PCI-DSS, and ISO 20022 through features such as secure data handling, audit logs, and real-time monitoring capabilities.

Geolocation Tracking

Provide location-based services, such as fraud detection based on geographic anomalies or location-specific offers and services.

Flexible Channel Management

Organize and manage communication channels dynamically for fine-tuned control over your app's data distribution and user access.